What are the benefits of buying without VAT?

- You pay a net price, 23% less.

- You do not have to apply for a VAT refund in the country where you run your business.

- You settle invoices with 0% VAT with your accountant as invoices for intra-Community supply of goods.

Who can receive an invoice with 0% VAT?

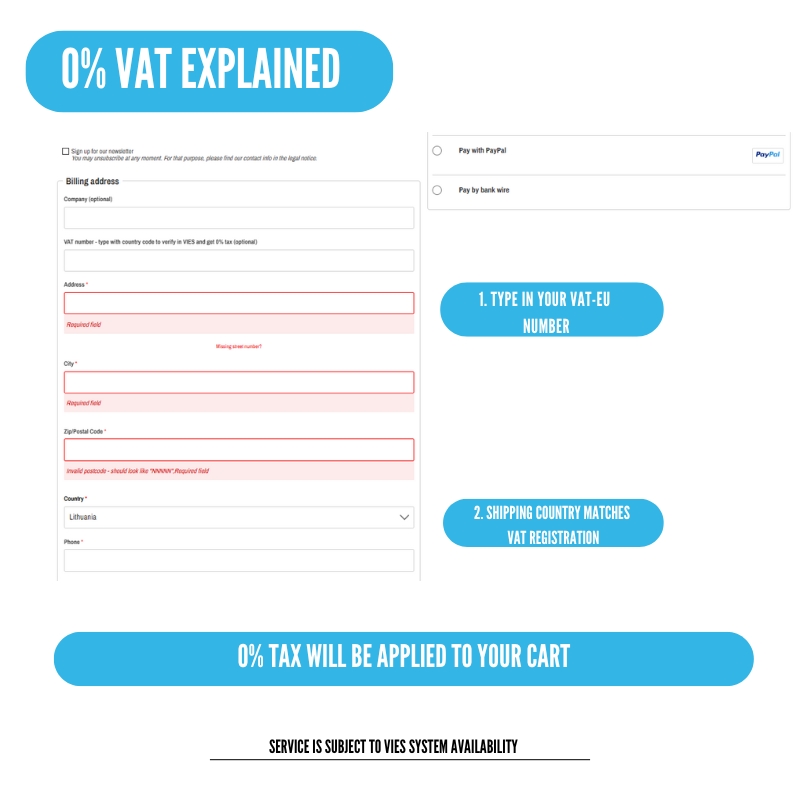

- Entrepreneurs with an active VAT-EU number and making purchases within the European Union.

- You must order the goods to be shipped to the country and address where the VAT-EU number is registered.

- All you need to do is enter the VAT number with the country code in the shopping cart, e.g. PL XXXXXXX - where PL is the country code and X corresponds to the VAT number.

- Please be aware that 0% VAT is applied subject to positive verification in VIES system - in case VIES service in unavailable we will not be able to verify your VAT-UE number.

0% Vat in 2 simple steps